In a pre-budget surprise, the Indian government has announced a significant reduction in import duties on parts crucial for mobile phone manufacturing.

The move aims to make mobile phones more affordable and strengthen the country’s position in the global electronics market.

The import duty, previously set at 15%, has now been lowered to 10%, providing relief for the mobile manufacturing sector.

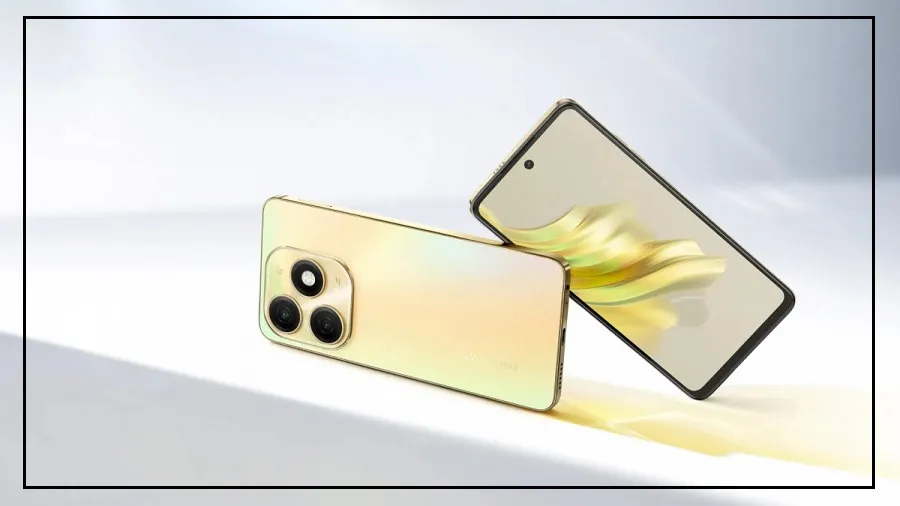

Parts with Reduced Import Duty: A Boon for Smartphone Affordability

The import duty reduction applies to various essential mobile phone components, including:

Battery cover

Main lens

Back cover

Plastic

Metal

SIM socket

Metal parts

Cellular module

Mechanical items

Additionally, other parts used in smartphone manufacturing will also benefit from the reduced 10% import duty.

This policy shift is anticipated to contribute to a potential decrease in the prices of upcoming smartphones in the Indian market.

ICEA Chairman Praises Government’s Move

Pankaj Mohindroo, Chairman of the India Cellular And Electronics Association (ICEA), has lauded the government’s decision as a critical and welcome policy intervention.

He emphasized that the move enhances the competitiveness of mobile manufacturing in India.

By scaling up and reducing input tariffs, the government aims to position India as a global hub for electronics manufacturing and exports.

Government’s Strategic Intervention

The reduction in import duties aligns with the government’s strategy to boost the economic condition of India, particularly by fostering growth in the manufacturing and export sectors.

This move is expected to attract global manufacturers and reinforce India’s standing in the electronics industry.

Impact on Premium Phone Manufacturers

Recent reports suggested that the government was contemplating a reduction in import duties on items essential for premium mobile phone production.

This decision is poised to benefit companies like Apple, potentially leading to increased exports from India and bolstering the country’s revenue.

Finance Minister’s Notification: A Key Policy Change

Issued by the Finance Minister, this critical policy change is aimed at promoting mobile phone manufacturing by reducing import duties on vital components.

The adjustment from 15% to 10% is anticipated to stimulate the industry and contribute to India’s vision of becoming a prominent player in the global electronics market.