Central Government employees and eligible National Pension System (NPS) subscribers have only a few days left to switch to the Unified Pension Scheme (UPS).

The Ministry of Finance has reminded all subscribers to submit their applications by November 30, 2025 to avail the benefits of this new pension framework.

The UPS was officially introduced on January 24, 2025, offering a redesigned pension plan for Central Government employees.

Officials are urging eligible employees, including past retirees under NPS, to act quickly before the deadline.

How to Apply

Eligible subscribers can submit their application in two ways:

Online: Through the CRA (Central Record-Keeping Agency) system.

Offline: By submitting a physical application to the respective Nodal Office.

All applications will be processed following the official procedure laid out in the government notification.

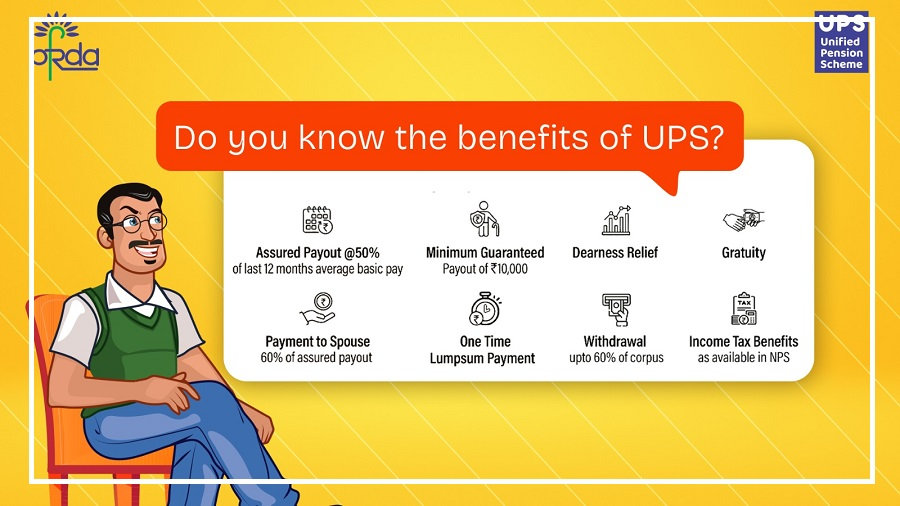

Why UPS Is Attractive

The Unified Pension Scheme brings flexibility and improved benefits compared to the old system:

Employees can switch from NPS to UPS easily.

The scheme provides tax exemptions under the revised structure.

Subscribers get better benefits in cases of resignation or compulsory retirement.

Additional provisions are included to ensure long-term financial stability.

A key advantage is that employees can switch back to NPS later, allowing them to adapt their pension plan to changing financial goals.

Who Should Apply Now

All Central Government employees and retirees previously under NPS who are eligible for UPS should complete the process immediately.

Missing the November 30 deadline will result in the loss of this option.

Employees are encouraged to review the benefits carefully and submit their applications on time, whether online or offline, to avoid last-minute issues.

What Is the Unified Pension Scheme

The UPS is a pension option under the NPS for Central Government employees, effective April 1, 2025.

It operates within the existing NPS framework regulated by the Pension Fund Regulatory and Development Authority (PFRDA).

The scheme applies to both serving and retired employees, depending on eligibility conditions, and aims to provide a flexible and secure pension solution.