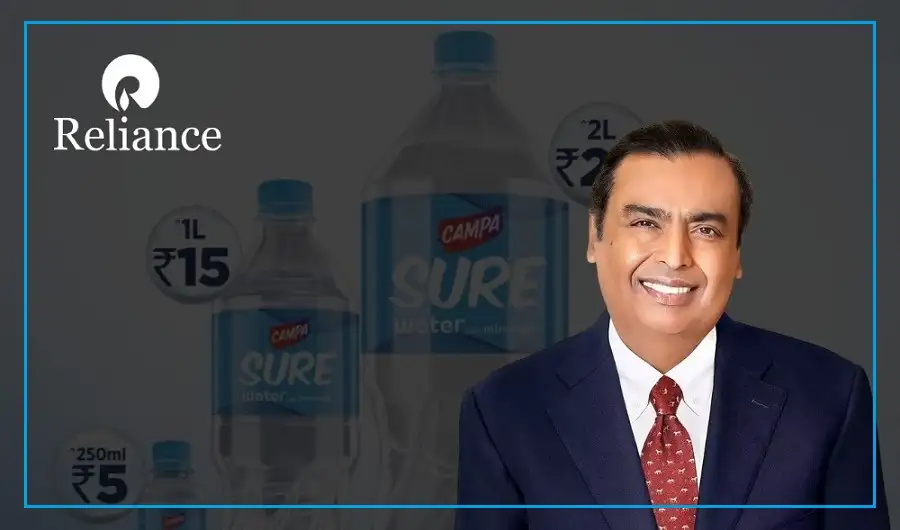

Reliance Consumer Products Limited (RCPL), the FMCG arm of Reliance Industries, has entered the bottled water segment with the launch of “SURE” mineral water.

Positioned as a high-quality yet budget-friendly option, SURE is priced 20–30% lower than leading brands.

This step marks Reliance’s move beyond beverages like Campa Cola into daily essentials, aiming at India’s fast-growing ₹30,000 crore packaged water industry.

Purity With Affordability: SURE’s Lineup

SURE water is designed to provide safe, mineral-rich hydration at competitive rates.

Each bottle undergoes reverse osmosis and UV purification to meet BIS standards while keeping essential minerals intact for taste and health.

Packaged in eco-friendly PET bottles, it is targeted at homes, offices, and on-the-go consumers.

Product Variants:

| Variant | Capacity | Price (₹) | Discount vs. Peers |

|---|---|---|---|

| Small Bottle | 250 ml | 5 | 20–30% (vs. Bisleri ₹7) |

| Medium Bottle | 500 ml | 10 | 20–30% (vs. Kinley ₹13) |

| Large Bottle | 1 L | 20 | 20–30% (vs. Aquafina ₹25) |

| Jar | 20 L | 80 | Bulk savings |

Available through Reliance Retail, JioMart, and Reliance Smart, SURE promises affordable and reliable hydration.

Guwahati Plant: Powering The Launch

The launch in February 2025 coincides with the opening of RCPL’s 6 lakh sq. ft. bottling plant in Guwahati, set up with Jericho Foods & Beverages LLP.

Highlights:

Capacity: 18 crore liters of water and 10 crore liters of soft drinks annually.

Product Range: SURE, Independence water, Campa Cola, Campa Orange, Campa Lemon, and Power Up.

Employment: Over 200 local jobs in Assam.

Technology: High-speed 583 BPM water line and eco-friendly bottling processes.

This plant boosts Reliance’s supply chain in the Northeast, allowing faster distribution and nationwide scaling.

Market Strategy: Breaking Into A Dominated Sector

India’s bottled water market is led by Bisleri (25% share), but Reliance plans to disrupt it with a price-leadership model.

The focus is on urban and semi-urban customers who want affordability without losing quality.

Reliance’s Key Strengths:

Lower Prices: 20–30% cheaper than rivals.

Strong Distribution: Over 18,000 Reliance Retail outlets.

Regional Focus: Northeast-first rollout before all-India expansion.

Brand Synergy: Fits well with Campa beverages and RCPL’s FMCG growth.

Analysts suggest this strategy could help Reliance grab 5–10% market share by FY26.

Challenges: Competition and Sustainability

Despite its strong entry, Reliance faces challenges. PET waste management and authentic mineral sourcing are key environmental concerns.

Competitors like Bisleri and Aquafina may also respond with discounts and loyalty schemes to defend their share.

Conclusion: A Bold Play For Mass Hydration

With “SURE,” Reliance is not just entering the bottled water market but making a strategic bet on affordability and scale.

By offering clean, mineral-rich water at low prices and leveraging its massive retail network, RCPL aims to make premium hydration accessible to all Indians.

If it succeeds, SURE could not only meet consumer demand but also reshape the competition in India’s bottled water industry.