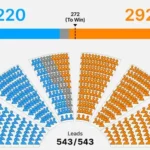

The Lok Sabha Elections 2024 will culminate on June 4, determining which political party will lead the country.

Experts predict that the BJP-led NDA will return to power, potentially causing a significant rise in the stock market.

However, some experts express concerns that if the BJP-led NDA wins fewer seats than expected,

the stock market may experience substantial corrections.

Market Reactions to Election Outcomes

An equity expert points out that unexpected election results could lead to a sharp decline in small-cap stocks and funds.

Ravi Saraogi, co-founder of Samasti Advisors, notes that many investors are holding cash and waiting for the election results, as the market’s reaction remains uncertain.

He advises a cautious approach.

Anirudh Garg, partner and head of research at Invaset, PMS, predicts that a strong BJP majority would positively influence the market.

Conversely, if the BJP falls short of a majority, it would create market uncertainty and short-term volatility.

He warns that an unexpected non-BJP government could lead to a market crash similar to the one in 2004 when the Congress party unexpectedly formed the government.

Ravi Singh, SVP of Retail Research at Religare Broking,

agrees that a strong Modi government majority would likely trigger a favorable market reaction.

Investor Strategies and Sector Focus

Experts advise investors to focus on long-term goals and avoid reacting to short-term market volatility associated with the election results.

Instead of getting swayed by immediate market fluctuations, investors should maintain a long-term perspective.

Before the election results, certain sectors are under focus, including Power, Tourism, Realty, Infrastructure, and Electronics System Design and Manufacturing (ESDM).

If the BJP-led government returns, stocks in these sectors could see significant gains.