Canara Bank has updated its fixed deposit (FD) interest rates, offering the best returns on select short- and mid-term tenures.

The new rates came into effect from January 5, 2026.

For senior citizens, the bank now offers up to 7% interest on certain callable FDs, even as overall FD rates have softened following policy easing by the Reserve Bank of India (RBI).

Best Returns on Special Tenure FDs

Short- and mid-term FDs continue to offer higher interest than long-term deposits, especially for senior citizens.

Here’s a quick look at the revised rates:

555-day FD:

General public: 6.50%

Senior citizens: 7.00% (highest callable rate)

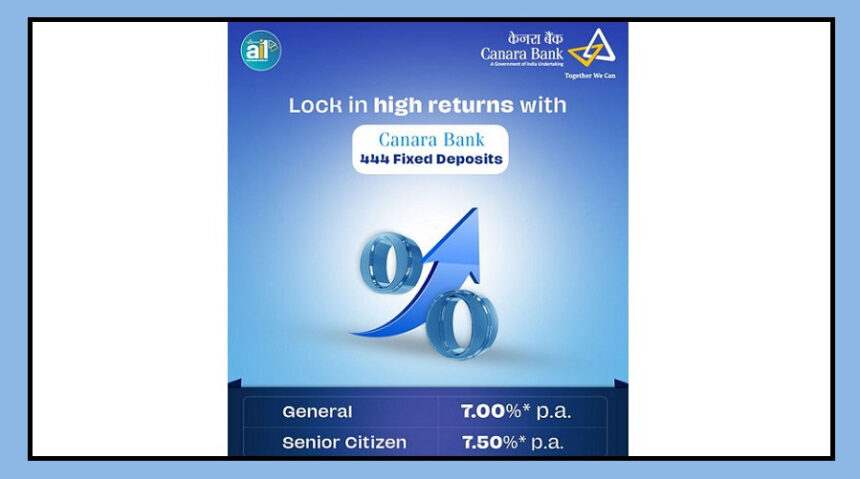

444-day FD:

General public: 6.45%

Senior citizens: 6.95%

For other callable tenures beyond one year, rates are capped at 6.25% for general customers and 6.75% for senior citizens, meaning longer lock-ins no longer offer extra returns.

Why FD Rates Are Falling

The decline in FD rates comes after the RBI reduced the repo rate by 125 basis points over the past year, bringing it to 5.25%.

Lower policy rates reduce banks’ funding costs, allowing them to cut deposit rates, particularly for long-term FDs.

As a result, multi-year deposits now offer lower returns than short- and mid-term options.

Other PSU Banks Also Cut FD Rates

Canara Bank isn’t alone—several public sector banks have also trimmed FD rates this month:

Bank of Baroda (from January 5)

General public: 3.50% to 6.45%

Senior citizens: up to 7.00%

Super senior citizens: up to 7.05%

Highest rate: 444-day Square Drive Deposit Scheme

Bank of Maharashtra (from January 7)

General public: 2.60% to 6.65%

Senior citizens: additional 0.50%

Highest return: 400-day special FD at 7.15% for senior citizens

What This Means for FD Investors

With interest rates trending lower, banks are promoting short- and mid-term FDs to attract deposits.

For investors, especially senior citizens, 400–555 day deposits currently offer better returns than long-term FDs, where rates have largely flattened.

This makes short- and mid-term FDs the preferred choice for maximizing returns in the current interest rate scenario.