Imagine you’re out shopping or enjoying a coffee at a cafe. When it’s time to pay, you check your bank account and realize it’s running low. Often, this leaves you embarrassed or forces you to borrow money from a friend.

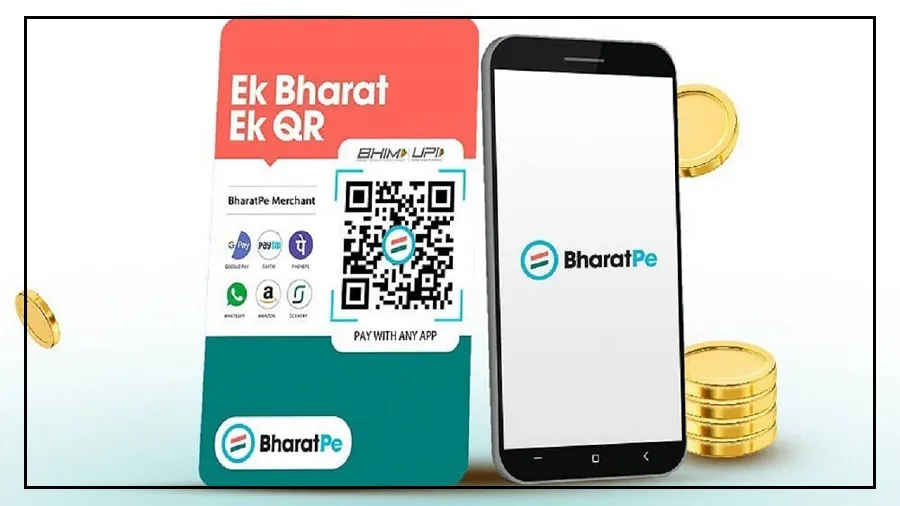

Now, there’s a solution. BharatPe, a popular Indian company, has partnered with Yes Bank to launch a service that keeps your spending smooth, even if your wallet is empty.

This new feature is called “Pay Later with BharatPe”, powered fully by NPCI. In simple terms, your UPI app now lets you borrow money—buy today and pay later.

This service benefits both consumers and small shopkeepers. Let’s explore how it works and the advantages it offers.

Instant Credit Without Paperwork

Earlier, even a small loan or credit card meant filling out numerous forms and visiting the bank multiple times. But in today’s Digital India, things have changed. With BharatPe’s new service, there’s no paperwork needed.

Yes Bank’s digital onboarding instantly verifies your credit profile and informs you of your credit limit.

Once approved, you can access this credit by simply scanning any QR code. The process is so simple that anyone can use it without help.

Interest-Free Payments for 45 Days

The biggest benefit is its interest-free period of 45 days. If you repay the borrowed amount within 45 days, you don’t pay any interest. This is perfect for people who wait for their salary at the end of the month.

After repayment, your credit limit is restored immediately, making this digital credit like a wallet that never runs out of cash.

Flexible Installment Options

If you buy something expensive and cannot repay within 45 days, there’s no need to worry. BharatPe allows you to convert your payment into easy EMIs for 3 to 12 months.

This feature is especially useful for small businesses. Shopkeepers can purchase goods for their stores and pay gradually, easing cash flow challenges.

This collaboration between Yes Bank and BharatPe strengthens India’s business infrastructure.

Rewards While You Spend

BharatPe doesn’t just provide credit—it also rewards your spending. Every transaction through the Pay Later service earns Zillion Coins via “BharatPe UPI Rewards.”

These coins can be used for future purchases, letting you enjoy the convenience of credit while saving money at the same time. It’s like getting rewards while you spend!

A New Hope for Small Traders

According to BharatPe CEO Nalin Negi, access to credit remains a major challenge for small businesses in India. Strict bank regulations often discourage them.

“Pay Later with BharatPe” bridges this gap, allowing merchants easy access to digital credit and helping them expand their businesses.

Anil Singh, Country Head of Yes Bank, shared his excitement about the partnership. He said their digital capabilities will provide customers with an unmatched experience.

This collaboration is more than a business tie-up—it could transform spending patterns for millions of Indians.