The Life Insurance Corporation of India (LIC) offers many policies that help people invest their money safely while also providing insurance coverage.

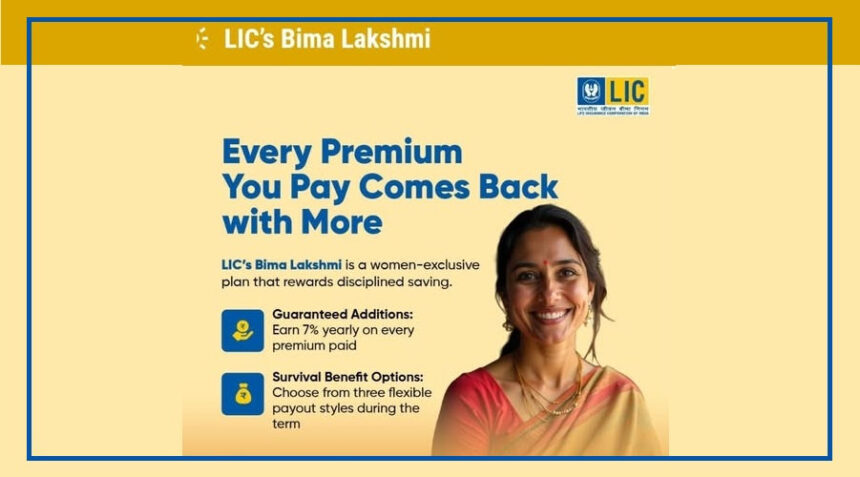

One such special scheme is LIC Bima Lakshmi Yojana, which is designed only for women. Only women are eligible to apply for and benefit from this policy.

This scheme provides women with both insurance protection and investment benefits. Let’s understand how the LIC Bima Lakshmi Yojana works and what it offers.

Key Features of LIC Bima Lakshmi Plan

LIC Bima Lakshmi is a non-linked, non-participating, money-back life insurance plan. It combines insurance coverage with savings and investment benefits. Women between the ages of 18 and 50 years can invest in this plan.

The policy term is 25 years, and the premium payment period can be chosen between 7 to 15 years, depending on the policyholder’s preference.

One of the main features of this plan is the survival benefit, which means a fixed amount is paid to the policyholder at regular intervals.

The policy also offers an additional assured benefit of around 7% on the premium every year, which increases the total maturity amount.

After completing three years of premium payments, the policyholder can avail of loan and auto cover benefits. Premiums paid under this scheme are also eligible for tax exemption under Section 80C of the Income Tax Act.

LIC Bima Lakshmi Yojana Premium and Benefits

The premium amount under the LIC Bima Lakshmi plan depends on the basic sum assured, policy term, and premium payment period.

For example, if premiums are paid for 15 years and survival benefits are received every two years, the policyholder can build a corpus worth several lakhs of rupees by the end of the policy term.

In case of the policyholder’s death during the policy period, the nominee receives the full insurance benefit, ensuring financial security for the family.