As festive sales on e-commerce platforms like Amazon and Flipkart kick off, many shoppers are tempted to use their credit cards for purchases.

The allure of incredible deals can lead to impulsive spending, often without realizing how much of your credit limit has already been used.

Some people may even max out their credit card limits, which can have serious repercussions for their financial health.

Let’s explore the potential consequences of overspending and the importance of managing your credit card usage wisely.

Understanding Credit Limits

A credit card essentially acts as a loan from the bank. When you use a credit card, you are borrowing money that you are expected to repay later.

Each credit card comes with a specific limit set by the bank, which is determined based on your credit score.

It’s crucial to stay within this limit while shopping.

The Risks of Maxing Out Your Limit

While you can technically use your entire credit limit, doing so is not advisable. Banks view customers who frequently max out their credit cards as high-risk borrowers.

This perception can negatively impact your CIBIL score, as it suggests you may be overly reliant on credit.

Although the bank might increase your limit over time, consistently maxing it out will still harm your credit score until you manage your spending more responsibly.

Monitor Your Credit Utilization Ratio (CUR)

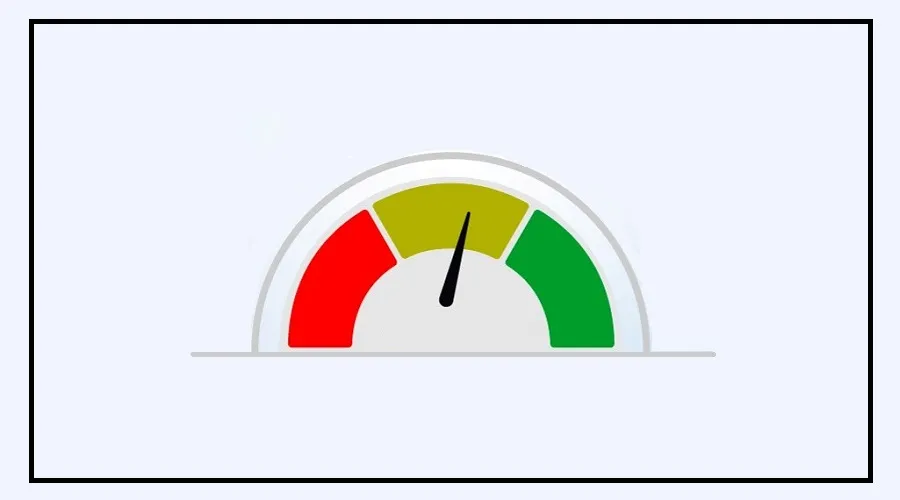

To maintain a healthy credit score, aim to keep your credit utilization ratio (CUR) between 30% and 40%.

If your CUR exceeds 50%, it could raise red flags for lenders, making it harder to obtain loans or resulting in higher interest rates when you do.

Your CUR is an essential factor considered when you apply for credit.

How to Calculate Your CUR

To calculate your credit utilization ratio (CUR), use the following formula:

- Total Due Amount: Determine how much you owe on your credit card.

- Total Credit Limit: Check your card’s total credit limit.

- Calculation: Divide the total due amount by the total credit limit and multiply the result by 100 to get the percentage.

For example, if your total due amount is ₹30,000 and your credit limit is ₹1,00,000, your CUR would be:

CUR=(30,0001,00,000)×100=30%CUR = \left( \frac{30,000}{1,00,000} \right) \times 100 = 30\%

Keeping a close eye on your CUR can help you maintain a healthy credit score and ensure that you remain eligible for favorable lending terms in the future.