In the Union Budget 2026, the government has given major relief to people who spend money abroad. The Tax Collected at Source (TCS) on overseas spending has been reduced.

Experts say this change will improve cash flow and make foreign education, medical treatment, and travel easier and more affordable.

Changes in TCS Rules

According to the new budget proposals, the TCS on remittances under the Liberalized Remittance Scheme (LRS) for education and medical treatment abroad has been lowered.

Now, if remittances exceed ₹10 lakh, only 2% TCS will be charged instead of the earlier 5%.

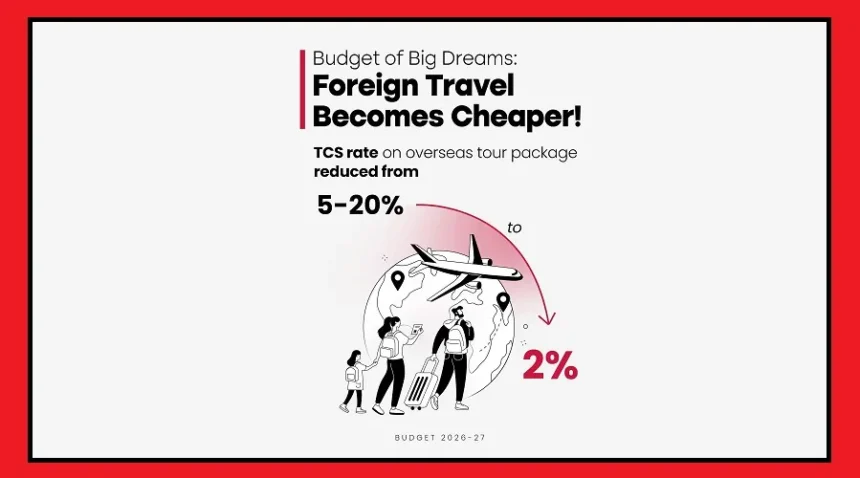

Foreign travelers have also received big relief. Overseas tour packages will now attract a flat 2% TCS. Earlier, the rate was 5%, and in some cases, it went up to 20%. Also, there will be no threshold limit for tour packages.

Benefits for Common People

Chartered accountant Prashant Thackeray says the reduction in TCS will immediately reduce the tax burden on individuals.

Although TCS can be adjusted later while filing income tax returns, higher rates earlier meant that money remained blocked for a long time.

This especially affected families sending money for children’s education, medical treatment, or foreign travel. With lower TCS, people will have more money available in hand, making it easier to manage expenses.

Relief for Students and Patients

Tax expert Anita Basrur says this decision is highly beneficial for the middle class. Earlier, high TCS created sudden financial pressure. The new system will improve liquidity while still allowing the government to track remittances.

This change will directly reduce costs for students studying abroad and families spending on medical treatment overseas.

Boost for the Travel Sector

The reduction in TCS on overseas tour packages will make foreign travel cheaper. It will also support the outbound travel, tourism, and hospitality sectors, which are recovering after the pandemic.

Experts believe that this TCS cut shows the government’s taxpayer-friendly approach. It will simplify foreign transactions, maintain regulatory control, and reduce the financial burden on ordinary people.