In the Union Budget 2026, the government announced an important change to make tax compliance easier for senior citizens.

Now, senior citizens will not need to submit Form 15H again and again to avoid TDS on interest earned from bonds, debentures, and other securities held in demat form.

While presenting the budget on February 1, Finance Minister Nirmala Sitharaman said that this step was taken to provide relief to investors who hold multiple securities in different companies.

What is Form 15H and Why is it Important?

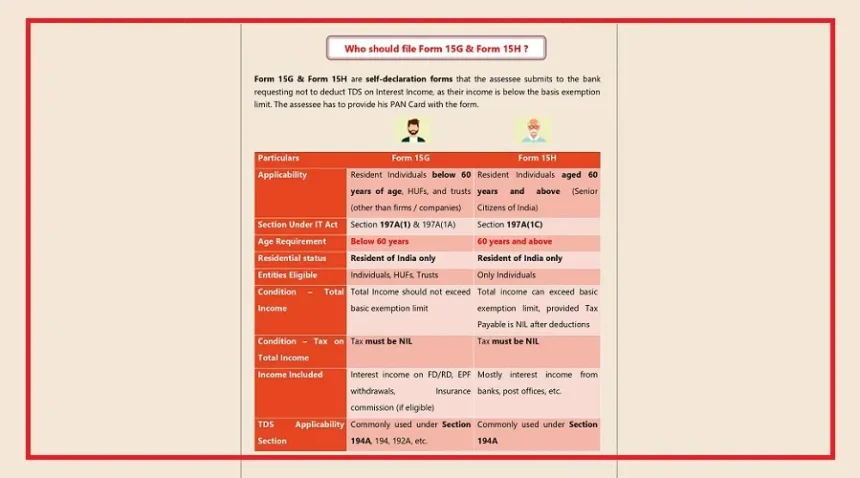

Form 15H is a self-declaration form that can be filled by resident senior citizens aged 60 years or above.

If their total taxable income is below the basic exemption limit, they can submit Form 15H to request that TDS should not be deducted on their income.

Senior citizens usually use Form 15H for income from:

Interest from bank fixed deposits (FDs)

Corporate bonds and debentures

Non-Convertible Debentures (NCDs)

Municipal bonds

Interest-bearing securities held in demat form

What Has Changed in Budget 2026?

Earlier, senior citizens had to submit Form 15H separately to every bank, company, or bond issuer. This process was complicated and time-consuming.

Under the new proposal in Budget 2026, senior citizens will only need to submit Form 15H once to their depository, such as NSDL or CDSL. The depository will then automatically share this information with all companies whose securities the investor holds.

However, this change mainly applies to bonds and debentures held in demat form. It does not apply to bank fixed deposits.

Benefits for Senior Citizens

This change will bring several benefits to senior citizens:

No need to submit Form 15H repeatedly to different companies

Big relief for investors who hold bonds from multiple companies

Reduced chances of TDS being deducted by mistake

Easier and smoother experience for bond investors

Special benefit for retail bond investors, many of whom are senior citizens

What Has Not Changed?

Some important things remain the same:

Eligibility rules for Form 15H have not changed

The age limit will continue to be 60 years

The income limit will remain the same

If a senior citizen’s taxable income exceeds the exemption limit, TDS will still be deducted as before