LIC offers insurance plans for people of all age groups, and to support women financially, it introduced a special policy last year.

This plan is designed to help women become more independent by offering safe savings along with guaranteed returns and regular payouts.

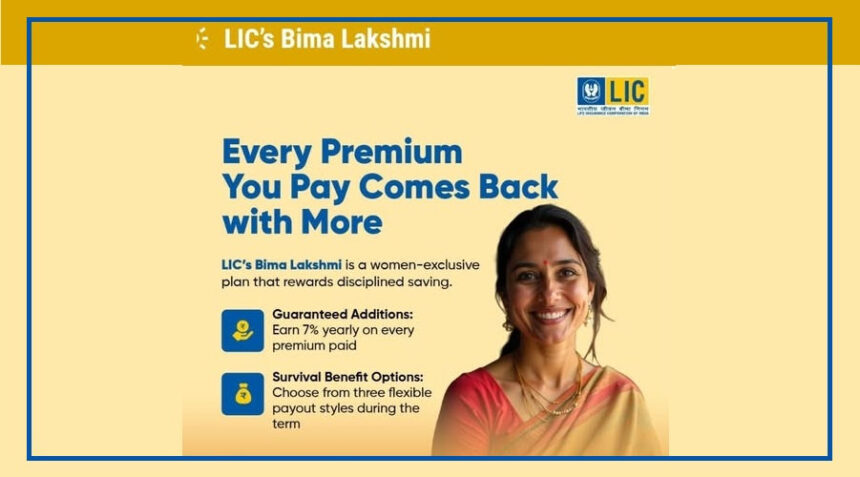

The policy we are talking about is LIC Bima Lakshmi Plan (Plan 881).

It is a money-back life insurance plan made especially for women, combining protection, savings, and assured benefits in one scheme.

What Is LIC Bima Lakshmi Plan?

LIC Bima Lakshmi is a life insurance policy that also helps you save money.

Along with insurance coverage, it provides fixed survival benefits at regular intervals and a lump sum amount at maturity.

The plan is risk-free and suitable for women who want long-term financial security with guaranteed returns.

Who Can Invest in This Plan?

Any Indian woman between 18 and 50 years of age can invest in this policy.

Minor girls can also be covered under this plan through a parent or legal guardian.

The total policy term is 25 years.

The premium payment period can be selected between 7 and 15 years, giving flexibility based on income and financial planning.

Key Features of LIC Bima Lakshmi

This plan offers guaranteed savings along with life cover.

Survival benefits are paid every 2 or 4 years during the policy term.

An annual loyalty addition of 7% is added, helping build a large maturity fund.

Optional riders like critical illness cover can be added for extra protection.

Policy loan and auto cover facilities are available after paying premiums for 3 years.

Tax benefits are available under Section 80C on premiums and Section 10(10D) on maturity.

How ₹4,450 Per Month Can Create a Big Fund

Let’s understand this with an example.

If a 40-year-old woman chooses this plan with a basic sum assured of around ₹3 lakh and a premium payment term of 15 years, the annual premium would be approximately ₹53,400, which comes to about ₹4,450 per month.

Maturity Amount and Returns Explained

At maturity, the total amount received can be quite attractive.

The estimated maturity amount is around ₹13.09 lakh.

Survival benefits of about ₹22,500 are paid every 2 years during the policy term.

The total amount received, including survival benefits, can reach around ₹15.79 lakh.

In total, the policyholder pays roughly ₹8.07 lakh in premiums over 15 years. After completing the 25-year policy term, she receives close to ₹16 lakh.

This makes LIC Bima Lakshmi a suitable long-term savings and protection plan for women looking for guaranteed and steady financial growth.