UPI has become an essential part of our daily lives. On average, people conduct about 60 to 80 percent of their daily transactions through UPI.

However, using UPI payment apps may soon come with additional costs. The government has significantly reduced the subsidy given to merchants for UPI services.

As a result, companies are now looking to recover these costs from customers, making UPI transactions more expensive. Some companies have already started charging fees.

Google Pay has introduced transaction fees of 0.5% and 1% for debit and credit card payments. Similarly, Paytm and PhonePe have begun charging fees for mobile recharges.

Government Subsidy Reduction

Until now, the government provided subsidies on UPI transactions below ₹2,000.

Every year, UPI merchant transactions cost the government around ₹12,000 crore, with ₹4,000 crore spent on transactions under ₹2,000.

Here’s how the subsidy has changed over the years:

2023: ₹2,600 crore subsidy was provided

2024: Subsidy reduced to ₹2,484 crore

2025: Subsidy further cut to ₹477 crore

How This Affects Daily Transactions

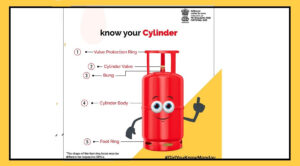

UPI is widely used for various payments, including shopping, fuel purchases, mobile and DTH recharges, bill payments, train and flight tickets, movie bookings, FASTag recharges, gas bookings, money transfers, metro card top-ups, and insurance premium payments.

With companies now imposing fees on UPI transactions, a large number of people will be affected, as millions of transactions worth hundreds of crores happen every day in India.

Many online payment service providers facilitate UPI payments, making it an integral part of the digital economy.

If UPI transaction fees are fully implemented, daily digital payments could become more expensive for consumers.