Years have passed since the implementation of the Goods and Services Tax (GST), the new indirect tax system.

However, continuous changes are still being made to improve it. Unfortunately, tax evaders are constantly devising new tactics, necessitating the tax authorities to constantly upgrade their measures.

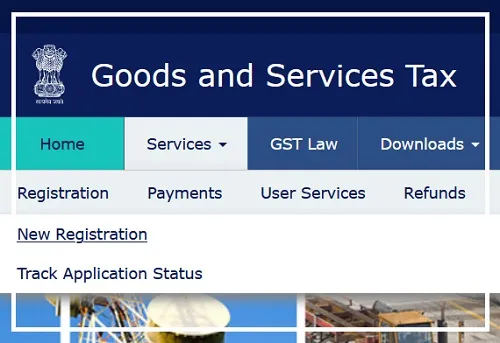

In light of several cases of Fake GST Registration and Fake Input Tax Credit (ITC) that have surfaced in the past, efforts are now underway to tackle this issue.

Tax officials have launched a dedicated campaign to address the problem.

Two-Month Campaign to Combat Fraud

The central and state tax authorities have commenced a special two-month campaign aimed at identifying bogus GST registrations and uncovering fraudsters who exploit fictitious Input Tax Credit claims.

These individuals fraudulently obtain ITC by submitting fake receipts, having registered on the GST platform without engaging in any genuine business transactions.

Subsequently, they deposit the ill-gotten profits into their accounts.

Rampant Tax Evasion

During the financial year 2022-23, it is estimated that GST evasion exceeded one lakh crore rupees.

In response, the Directorate General of GST Intelligence (DGGI) managed to recover Rs 21,000 crore in unpaid taxes.

To address the issue, tax authorities have initiated measures to crack down on fake registrations.

Unveiling the Tactics

The GST Policy Cell of the Central Board of Indirect Taxes and Customs (CBIC) recently issued a letter to Chief Commissioners of Central Taxes, highlighting the prevalence of fake GST registrations and the issuance of counterfeit receipts for fraudulent ITC claims.

CBIC emphasized that these unscrupulous practices result in significant revenue loss for the government through dubious and intricate transactions.

Strategies to Catch the Culprits

All central and state tax departments have jointly launched a special campaign from May 16th to July 15th.

The campaign aims to identify suspicious GST accounts and eradicate fake invoices from the GST network.

To achieve this, advanced data analysis and risk parameters on the GSTN will be utilized to identify bogus registrations.

Verification and Consequences

Upon receiving information regarding fake registrations, steps will be taken to verify the suspected GST Identification Numbers.

If a taxpayer is found to be operating with a bogus registration during the Aadhaar-based verification process, immediate action will be taken to cancel their registration.

Presently, there are approximately 1.39 crore taxpayers registered under the GST system nationwide.

The GST regime was implemented in July 2017 as a uniform indirect tax system.

Our Thoughts

With ever increasing popularity of GST systems and day by day increasing registrations, the case of fraud and forged registrations are also increasing. It was very important to stop such individuals.

This drive from GST Authorities will help India in a long run. This drive will not only eliminate fraud registrations from system but will also enable authorities to track the loopholes and fill them in future developments.

Are you a GST user? Do you like it? Comment below.