If you’re interested in checking your CIBIL score without any charges, this article will provide you with valuable information.

It’s important to be aware of your creditworthiness as loan companies typically assess your CIBIL before approving credit cards or loans.

Methods to Check Your CIBIL Score

1. Checking CIBIL on Official Website

One way to check your CIBIL for free is through the official CIBIL website. Here’s how you can do it:

1) Visit the official website of CIBIL (www.cibil.com). Select “GET FREE CIBIL SCORE & REPORT” or a similar option.

2) Provide the necessary details such as your name, address, PAN card number, Aadhaar card number, etc. Answer the security questions and click on “Submit”.

3) After verification, you will receive your recent Score and Report at no cost. You can also choose to download and print the report in PDF format if needed.

2. Checking CIBIL through Financial Institutions

Many banks and financial institutions offer free CIBIL checking services to their customers. You can inquire with your financial institution regarding this facility.

Here’s how it can be done:

1) Visit the branch of your financial institution. Provide the necessary details for verification.

2) The institution will provide you with your recent score based on their evaluation.

3. Checking CIBIL on Google Pay App

1) Download the Google Pay app from the Google Play Store or App Store. Sign in using your phone number and Google Account.

2) Follow the on-screen instructions to link a bank account to your Google Pay account.

3) Optionally, you can also link any debit or credit cards associated with the same mobile number.

4) Once your account is set up, follow the steps provided in the app to check your CIBIL score for free.

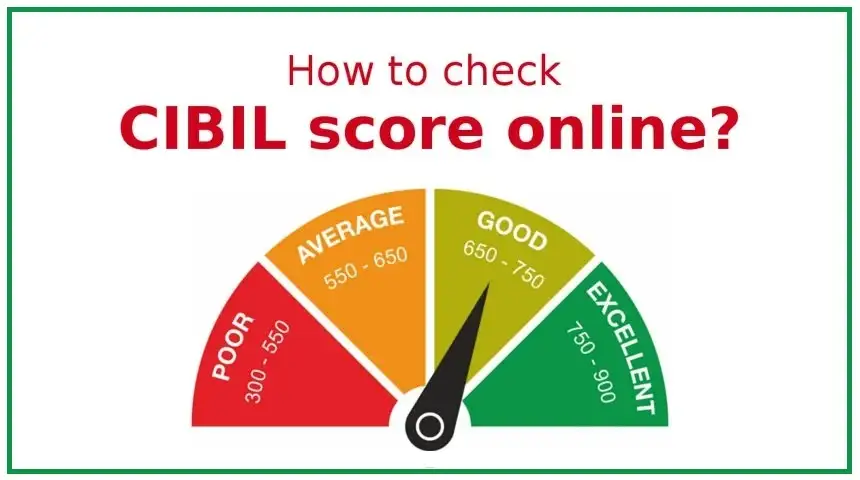

Best CIBIL Score Range

The ideal CIBIL score ranges from 300 to 900. A higher score reflects better financial prospects and enhances your creditworthiness.

Generally, a CIBIL score above 750 is considered excellent, providing more opportunities for loans and credit approvals. However, it’s important to note that different financial institutions may have varying criteria for lending decisions.

Factors such as income, credit history, and payment schedule also influence creditworthiness.

While having a good CIBIL is beneficial, individual financial potential is also considered by lenders.

Five smart ways to improve your CIBIL Score

Factors such as your loan or credit card payment history, utilization of total credit, types of credit, duration of credit history, and all recent enquiries made by you influences your CIBIL value.

- Pay all your Credit card bills and EMIs on time

- Use a low amount of your total credit limit

- Avoid applying for multiple loans at once or in short duration gap

- Try to have Diversified loan accounts

- Have a Regular on check your credit report

Being aware of your CIBIL is crucial for understanding your financial standing and addressing any discrepancies or errors in your credit report.

By checking your CIBIL regularly, you can take the necessary steps to improve your creditworthiness and financial prospects.

CIBIL Score Overview

The CIBIL score is a numerical representation used in the Indian financial market to evaluate an individual’s financial performance.

It is prepared by the Credit Information Bureau India Limited (CIBIL).

Ranging from 300 to 900, the CIBIL score measures your financial standing, assessing factors such as credit card usage, loan history, repayment patterns, and loan amounts.

Timely payments and responsible financial management result in a higher CIBIL score, indicating a good credit standing and financial responsibility.