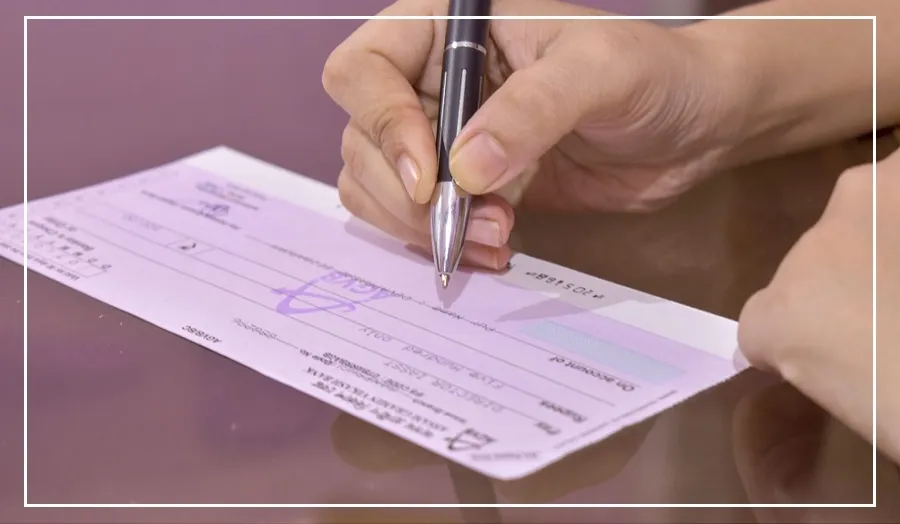

In India, check bounce is a serious financial offense that can lead to legal consequences, including imprisonment.

It is crucial to be aware of your rights and the actions you can take in case of a bounced check.

Legal Consequences for Check Bounce

Legal Notice

If a check bounces, a legal notice will be issued to the issuer. Failure to respond within 15 days may result in legal action under Section 138 of the Negotiable Instrument Act, 1881.

Section 138 Proceedings

If the issuer does not address the legal notice, proceedings can be initiated under Section 138 of the Negotiable Instruments Act, 1881.

Punishment for Check Bounce

Maximum Punishment

The law stipulates a maximum punishment of 2 years and a fine for check bounce under Section 138. However, typical court sentences range from imprisonment up to 6 months to 1 year.

Penalty for Check Bounce

Financial Penalties

The penalty for check bounce can range from ₹150 to ₹750 or ₹800. Additionally, imprisonment up to 2 years and a fine up to double the amount specified in the check may be imposed in cases where the check giver lacks sufficient funds.

Appealing Against Check Bounce Penalty

Bailable Offense

Check bounce is a bailable offense, meaning the accused does not go to jail until the final decision is reached.

Appeal Process

If convicted, the individual can appeal to the trial court under Section 389(3) of the Criminal Procedure Code.

Understanding your rights and the legal recourse available is essential when dealing with check bounce situations.