By the end of February, North India had started experiencing warm weather. However, with the arrival of March, the weather has changed again.

Cold winds in the mornings and evenings have forced people to bring out their sweaters and warm clothes once more.

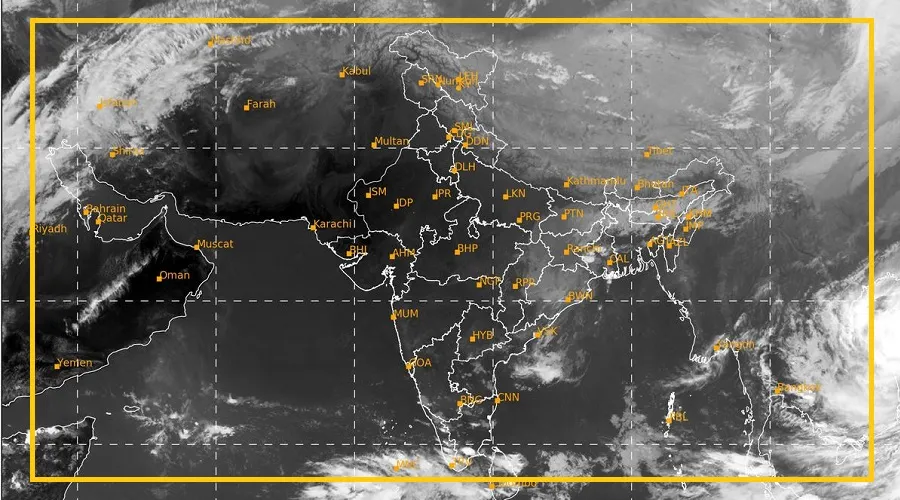

In Delhi-NCR, strong winds have increased the cold. According to the Indian Meteorological Department (IMD), while Delhi-NCR will have dry

and clear weather for the next few days, other states have been put on alert for heavy rain and snowfall.

Rain and Snowfall Expected Due to Western Disturbance

Weather experts predict that a western disturbance will cause rapid changes in the weather across both hilly and plain regions of North India.

Many places may experience hailstorms and rain with strong winds. Over the next three to four days, heavy rain, snowfall,

and strong winds are expected to affect several states, including Jammu and Kashmir, Himachal Pradesh, Uttarakhand, Ladakh, Bihar, Assam, and Sikkim.

Rain and Snowfall Alert for Hilly Areas

According to the Meteorological Department, significant weather changes are expected in the hilly regions over the next two days.

Due to the impact of the western disturbance, rain and snowfall are likely from March 9 to March 11.

High-altitude areas in Jammu and Kashmir, Himachal Pradesh, and Uttarakhand may experience heavy rain and snowfall between March 9 and 13.

Temperature to Rise Soon in North India

Apart from the hilly regions, states like Assam, Sikkim, and Bihar may also witness rainfall. Cold winds continue to make the mornings and nights chilly across North India.

However, the strong winds that have been affecting Uttar Pradesh, Bihar, and Jharkhand for the past few days are expected to subside soon.

As a result, temperatures in these states will start rising, bringing in warmer weather.

While mild heat will be felt during the daytime due to sunshine, the nights may remain cool for some time.